A technological revolution is going on in Brazil. In 2011, only 56% of Brazilians had a bank account. Brazil was estimated to be the most capital-intensive country for banking in the world, and is thought to have (even now) a highly dysfunctional credit system, which is extremely congested particularly for small and medium sized companies.

Today, those numbers are up substantially. Despite having an inflation rate of over 11%, and serious political turmoil, something is changing. Brazil now has the one of the largest numbers of FinTech startups of any country in the world. A handful of superstar FinTech businesses are rocking the world, following in the footsteps of e-commerce giant MercadoLibre by creating supercharged financial ecosystems on a massive scale. Serial entrepeneurs are taking Brazil from a country that has historically been infamous for scams and massive wealth discrepancy, to one of the most interesting economies in the world (well, in my opinion).

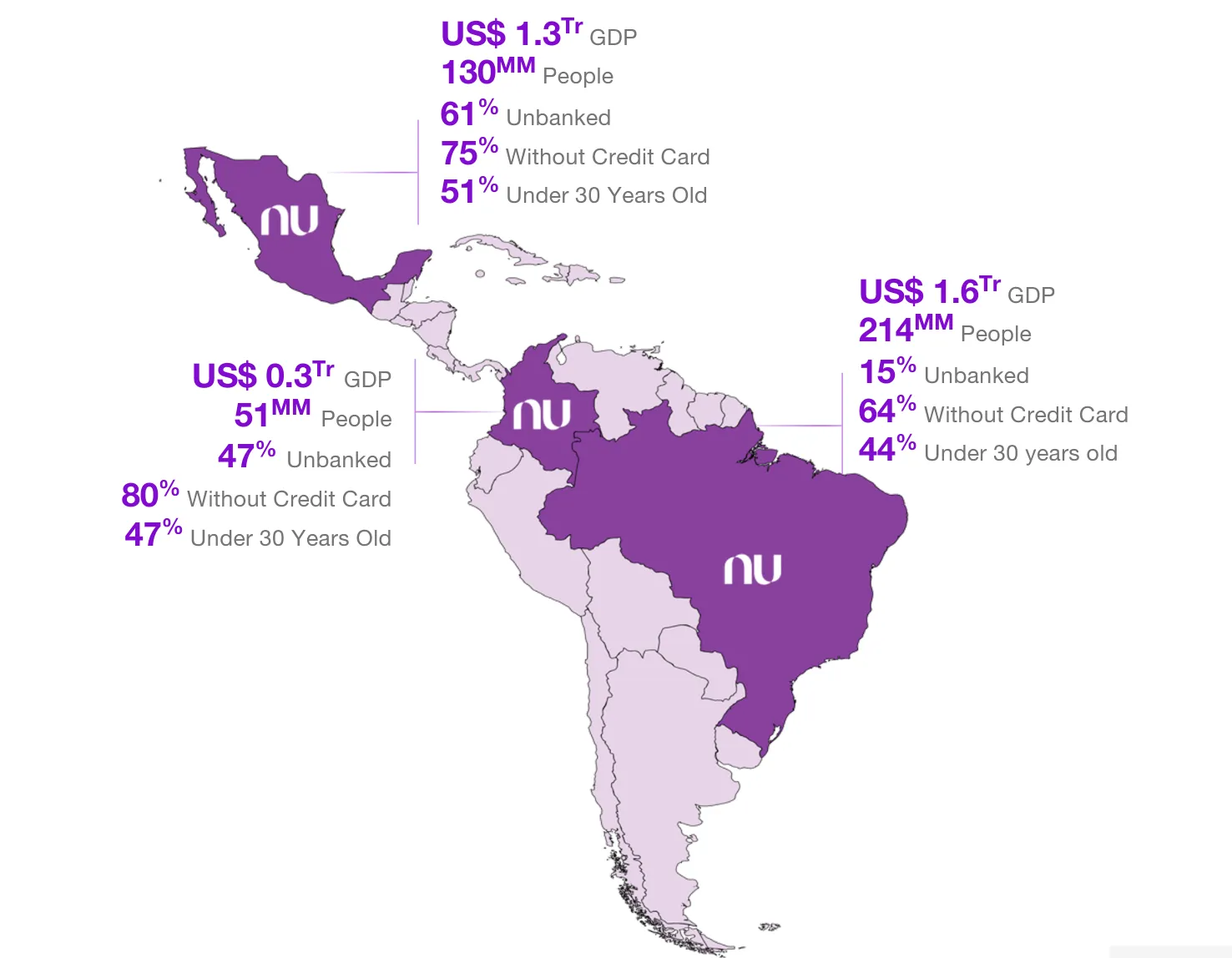

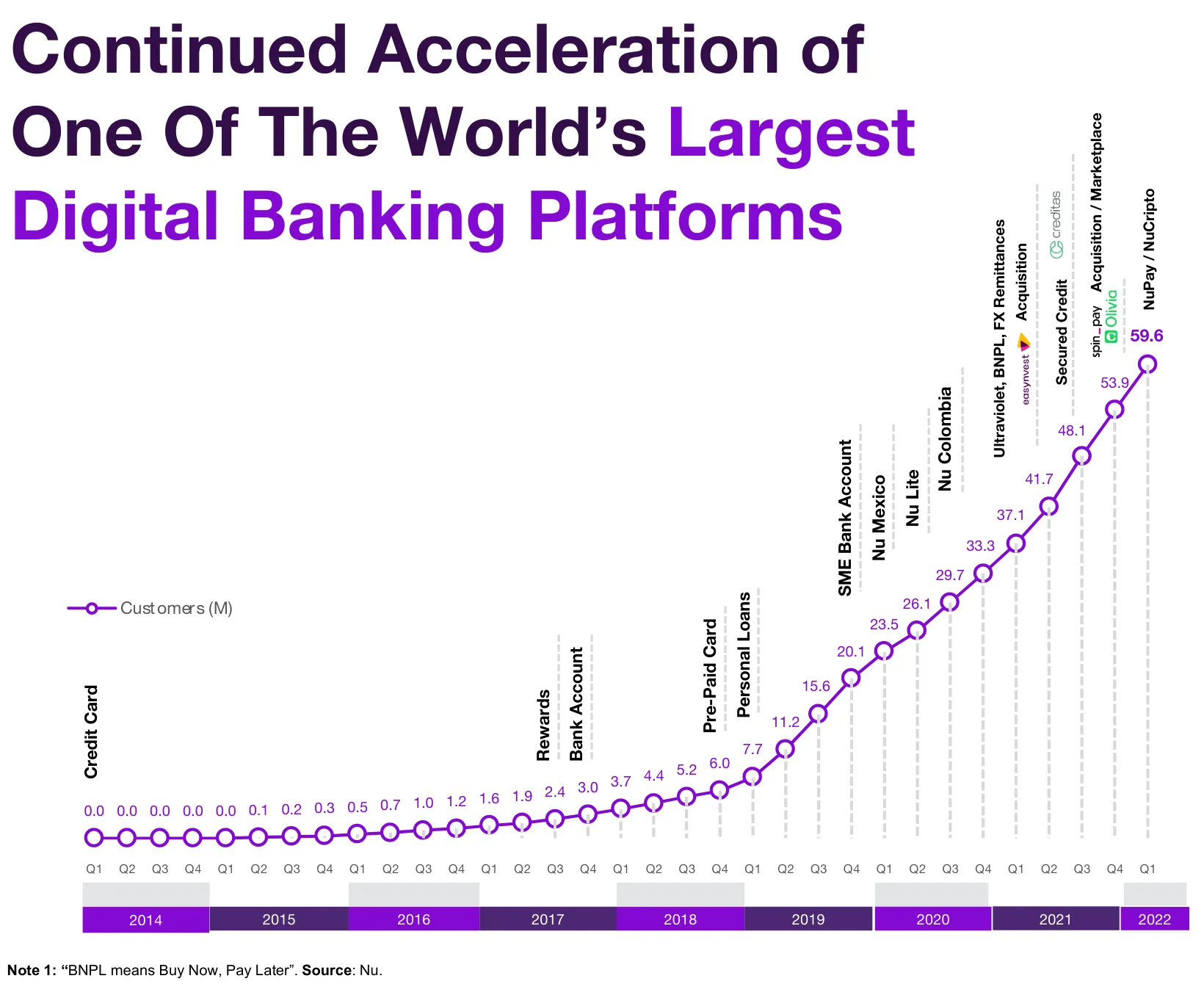

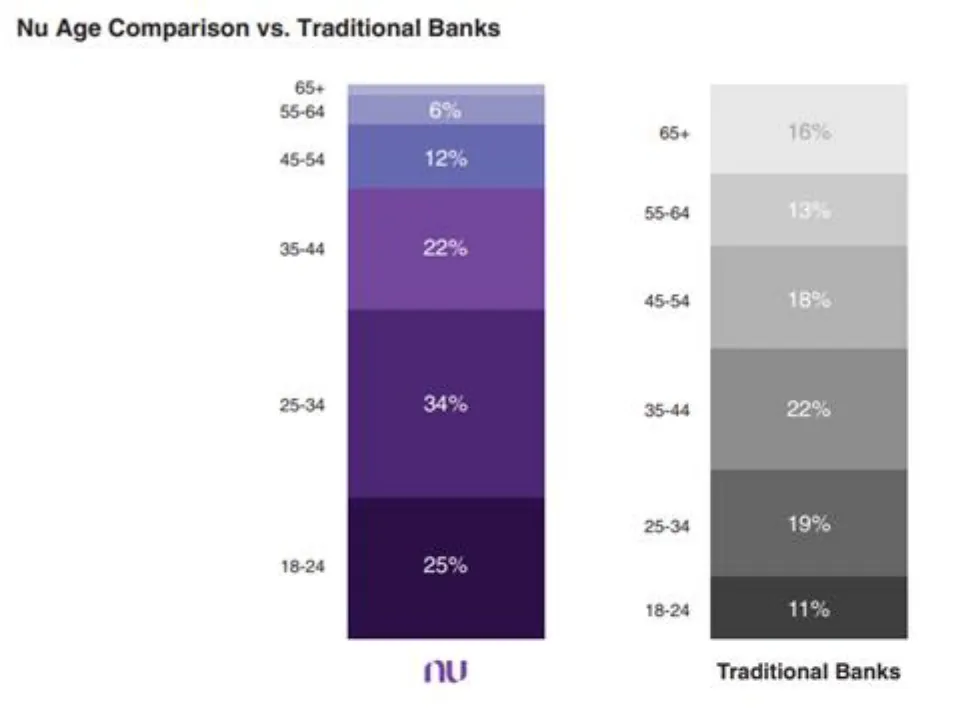

One of the prime examples of this revolution is Nubank. For those who don’t know, Nubank is a Neobank, which means it operates almost exclusively digitally, without physical branches. This asset-light model allows Nubank to drastically reduce operating expenses. Its primary founder, David Vélez, a young Colombian, began Nubank in 2013 after noticing a handful of banks controlled the majority of Brazil’s markets and realising how horrible the experience was. The lack of competition, he felt, led to a lack of innovation, and this inspired him to start Nubank. Only a few years old, it now has over 48 million customers (growing exponentially) in Latin America, and has been an investment target of Warren Buffett since pre-IPO. Moreover, the average age of users is significantly below that of other banks.

What makes this even more impressive is that Nubank did all of this without expanding outside of Latin America, and with a policy of zero marketing spend - relying entirely on word of mouth to grow. How? They focused entirely on improving their technology and offering. In their words, “We are a technology company, it’s in our DNA, not a bank.”

As one of the first pioneers of the ongoing transformation of the Brazilian financial system, you might not be surprised that Clojure is Nubank’s weapon of choice. Clojure and Nubank share a few similarities, after all. Both are very modern. Both are highly streamlined. Both are piloted by highly intelligent and contrarian leaders, and aimed at undermining stagnant legacy systems. Nubank’s motto? “Fight complexity to empower people”. Through looking at Nubank’s previous open source work, it clearly excels at building horizontally scalable microservices, and claims that because services in the financial domain closely resemble mathematical functions, functional programming is a natural fit. They say that they’ve eschewed the boilerplate and verbosity of other languages, in favor of simple constructs. And they aim to keep their codebase understandable locally, and practically testable. It’s clear from their numerous articles that at Nubank, engineers are just as passionate about software as every other Clojure engineer I have met (and as an old-fashioned Lisp programmer looking in, Clojure developers have something of a reputation for being, let’s say, pretty dedicated).

So as a finance dweeb, and a software engineer, I was very happy to find out that Nubank had acquired Cognitect (and by proxy, Rich Hickey). I think this was a very smart decision on their part. If I was leading a large financial firm, I would also be acquiring high-level consultants who specialise in (and in this case created) the technology I use. I’ve joked to colleagues before that if they could, I’m sure Jane Street would acquire the entirety of French academia. One might be concerned that this could threaten Clojure’s status as an open source licensed language, but that’s not really something to be worried about. Nubank know very well about the importance of Clojure being open source. The main benefit of the acquisition, conversely, is to fund Clojure and Datomic’s development, and receive continued support from Cognitect on architectural decisions. It’s not wrong to be concerned about the ethics of a large company when it makes an acquisition, but Nubank has a history of continued open source library output and does not benefit at all from stifling Clojure’s adoption. One can look at libraries such as the popular workspaces for an example of the kinds of tooling a large company with access to bright minds can provide to a language’s ecosystem.

So why doesn’t Nubank keep all its software to itself or create a fork of Clojure? Firstly, Clojure is owned by neither Cognitect nor Nubank. It is open source, with Rich Hickey controlling its trajectory- so no need to be concerned as to the locus of Clojure’s progression. On the other hand, perhaps people may be wondering about what Nubank may be able to do for Clojure. The fact is that open source is good for tech companies. It’s no wonder that two of the best open source developer tools, GraphQL and React, both came out of Meta, which itself is actually a highly controversial company. The reasons are quite simple. Meta has never been afraid to hire outside of narrow pools, and it’s never been afraid to invest in architecture that doesn’t appear to have a direct use-case. Meta’s competitive advantage is its willingness and ability to attract the best developers and to act outside the norm. Jane Street, mentioned earlier, dominates the OCaml ecosystem. A company the size of Nubank could do something similar for Clojure, especially given it is a fast-growing force that shows no signs of slowing. Who knows what in the future will be powered by Clojure?